Investment Baskets - Invest Wisely in the Equity Markets

At investmentz.com, we offer a set of baskets to meet your investment needs. Each basket is customized to provide assured equity & debt exposure through a portfolio of stocks, Mutual Fund, ETF, and other asset classes. These baskets are monitored by our team consisting equity & debt specialists, who can help you to make disciplined investments aligned to your financial goals. The baskets are constructed to suit different types of investor risk profiles.

- What are ACEs?

- Why do I need Aces?

- How to select an Investment Basket?

- Our Stock Baskets

- How to invest in basket?

- Safety

- Liquidity

- Stock Selection Methodology

- Download Brochure & Factsheet

- Our Performance

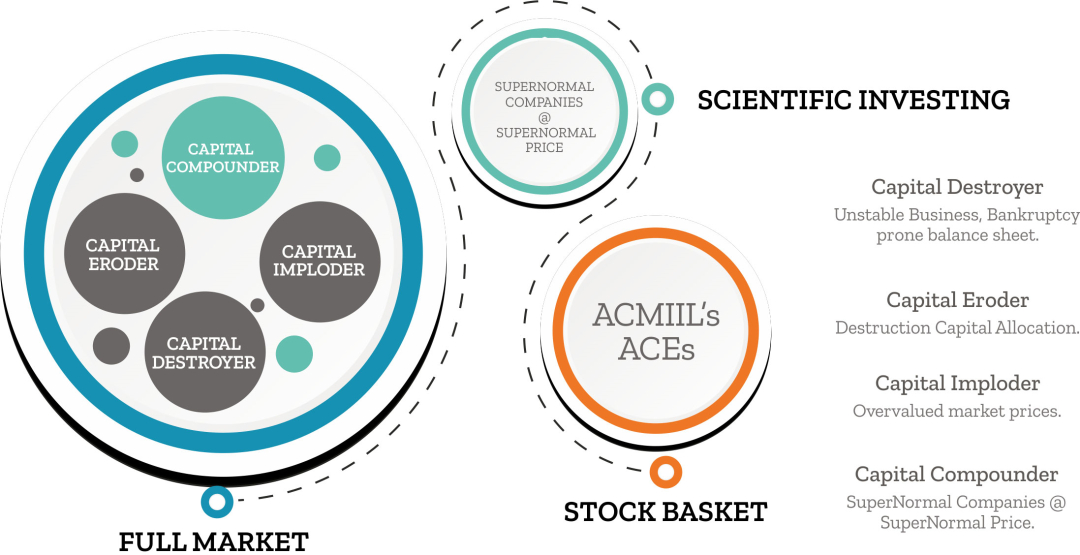

What are ACEs?

An ACE is a Supernormal stock basket based on the scientific Investing framework to enhance safety and enhancing returns. Each ACE is designed to provide required equity exposure through a stock portfolio of 10-12 different companies ranging from Small/mid-caps to large caps. These ACEs are managed by an Equity specialist team.

Why do I need Aces?

We have observed that many investors are investing directly in the equity market based on poor research, or stock tips which are considered unethical manner of investing. This approach is not only risky but also is guided by emotions and hence, does not help in generating long-term wealth. The net result is erratic and sub-optimal equity returns.

How to select an Investment Basket?

Based on your risk appetite, you can select a basket. In order to keep it simple we have just 3 types of ACEs (Stock Basket) namely ACE-LARGECAP, ACE-MIDCAP and ACE-SMALLCAP. This reflects the current market composition. You can also create your own basket of stocks ( in process)

Investment Baskets can either be purchased in lump sum or in SIP. It is advisable to start an SIP so that there is regular saving habit and you can also average the price by buying during different points of time in the market.

Our Stock Baskets

ACE-Largecap

1. Supernormal portfolio is created from the large-cap universe of Top 100 stocks.

2. The large-cap universe is a reflection of the Indian economy as it accounts for nearly 50% of the organized GDP of India.

3. 8 to 12 Supernormal companies are available at Supernormal Prices and are regularly monitored as well as realigned by our equity specialist team.

ACE-Midcap

1. Supernormal portfolio is created from the Mid-cap universe of next 150 stocks beyond the top 100 stocks.

2. The midcap universe offers exposure to stocks which are next level industry leaders from a wide range of Industries.

3. 8 to 12 Supernormal companies are available at Supernormal Prices are regularly monitored and realigned by our equity specialist team.

4. Midcap Portfolio can have higher volatility compared to Largecaps.

ACE-Smallcap

1. SuperNormal portfolio is created from the Small cap universe beyond the top 250 stocks.

2. The Small cap universe offers exposure to upcoming companies in their respective industry.

3. 8 to 12 Supernormal companies are available at Supernormal Prices and are regularly monitored and realigned by our equity specialist team.

4. Small cap Portfolio can have significantly higher volatility compared to Large/Mid caps

How to invest in basket?

Open an account with us, Register a mandate for SIP and our website will offer user-friendly link to purchase the basket. Subsequent purchases of SIP are made automatically by us.

Safety

There is a higher element of safety since there is a scientific process involved in selecting the basket stocks. However just like any other equity investments it is subject to market risk.

Stocks are not frequently replaced, but continuous monitoring and replacements are done if a company is not performing on anticipated growth plan expected during the time of investment.

Liquidity

High liquidity occurs because frequently traded stocks are selected. However the shares are selected based on long term duration i.e. at least 3 years.

Stock Selection Methodology

Download Brochure & Factsheet

Download Brochure Larg Cap Factsheet Mid Cap Factsheet Small Cap Factsheet

Our Performance

| ACMIIL's ACES | Date of Inception | 1M | 3M | 6M | 1Y | Since Inception |

| ACE -LARGECAP | Friday, May 15, 2020 | 1.65% | 4.16% | 25.42% | 67.52% | |

| Benchmark (BSE 100) | 0.95% | 5.41% | 30.48% | 60.45% | ||

| ACE-MIDCAP | Wednesday, May 20, 2020 | 3.59% | 10.30% | 28.79% | 81.84% | |

| Benchmark (BSE Midcap) | 1.01% | 12.48% | 37.24% | 78.94% | ||

| ACE-SMALLCAP | Tuesday, May 26, 2020 | -1.50% | 9.31% | 30.47% | 99.97% | |

| Benchmark (BSE Smallcap) | 2.45% | 14.10% | 38.89% | 94.98% |

All Performance above are as of 31st March 2021.

Performance up to 1 Year is absolute and above 1 Year is CAGR

Disclaimer: Past performance is not indicative of future performance and future results. Above portfolio performances are post fees and Performance computed on model portfolio. The recommendations made by ACMIIL could be those that are based on its own research. Individual returns of Clients for a particular portfolio may vary significantly from the performance of the other portfolios. No claims may be made or entertained for any variances between the performance depictions and individual portfolio performance. Investments in securities market are subject to market risk, read all the related documents carefully before investing.